RESOURCES

BLOG

Join in the community forum! The thINK blog is a place for community members to share their opinions, best practices, successes, and challenges. Add your comments to the blogs published here or write a blog and we’ll post it for you.

thINK Ahead 2024 Recap

In its 10th year, the thINK inkjet Canon user group conference brought together almost 500 Canon production inkjet customers, partners and print industry experts to the very luxurious Boca Raton Resort. Since the first Canon thINK Ahead event in 2015 held in New York City, cumulatively almost 5,000 people have attended over 150 breakout sessions. It has become a club of sorts, a must attend event if one is a U.S. Canon production inkjet customer or partner. There is lots of opportunity to network, to learn, and to share the challenges and opportunities faced on a daily basis.

Figure 1 Opening Night at Canon thINK 2024

One of the hallmarks of this event is the openness of participants to share the good and the challenging issues facing us as a print industry. It is not a Canon sales event, with very little focus on Canon products (prospective customers are invited to learn more about Canon products at the Inkjet Insider event held a day prior at the Customer Innovation Center a few minutes up the road from the resort,). The focus is mainly on operational issues, from best sales practices to taxation complexities.

As one participant noted, she founded a general commercial printshop to put ink on paper, but she now spends most of her time dealing with Wayfair tax and immigration issues to help her hard working Latino workforce. Events like this allow her to stay current on possible solutions to these challenges.

Canon Update

In the spirit of openness and to illustrate how Canon is co-investing in the future of digital production printing, Francis A. McMahon, Executive Vice-President of Canon, Production Print Solutions, shared a few highlights of Canon’s investments, timing on product releases, and business results.

Service Expansion

Service for Canon production printers is being consolidated under Canon USA’s service division, which has been responsible for copier/MFP service and now will also be responsible for production printing. This will expand the number of available field service technicians. Canon is also opening up a dedicated training facility in Boca Raton, FL for training and re-training for both Canon Service Technicians and Canon customers in a new $1.5M dedicated facility that will open in Q3, 2024. Customers will be able to send up to two employees for 1st level service training starting in Q1, 2025. The goal is to enable customers to benefit from maximum uptime especially during peak demand times. Correspondingly Canon is also increasing parts availability and service tooling, all in an effort to further support and enhance customer uptime.

New Product Availability

At DRUPA, Canon announced several brand-new thermal and piezo inkjet technology platforms that will make their entry including the varioPRINT iX1700 (B-3 inkjet) and the varioPRESS iV7 (B-2 inkjet). The first varioPRINT iX1700 has been installed at Canon’s Boca Raton Innovation Center, with a goal of having the first betas installed at customers in Q3/4 of 2025. Full commercial availability in the U.S. is expected in Q1, 2026. Similarly, the varioPRESS iV7 is expected to have U.S. availability in around the same timeframe.

Figure 2 Canon LabelStream LS2000

Both inkjet presses feature new printheads, new paper transports, and new ink technology, yet to be tested in the U.S. and Europe with local substrates, applications, and environmental/operating conditions. In 2026 Canon will also be releasing Canon’s first production inkjet label press in the U.S., the LabelStream 2000. (See IT Strategies DRUPA review for product details).

Canon Solutions Business Results

In the first half of 2024, Canon’s hardware revenue was up 6% year/year, and supplies/service revenues were up 4%. This has led to the strongest first half results in Canon Production Print Solutions’ history. Calendar year to date, the division has installed 15 varioPRINT iX3200s; 26 ColorStream engines; 10 ProStream engines; and 102 monochrome toner varioPRINT (Titans & VPDP) engines. It is a leading indicator that print providers are starting to feel a bit better about capital investments, as the U.S. economy remains strong and there is anticipation for interest rate reductions later this year.

Breakout Sessions

There were many breakout sessions, including a Marketing session and the Pricing for Profit – those two were very highly rated sessions. We’ll highlight two IT Strategies believes have a direct impact on print providers business: improving sales and taxation.

Improving Sales

One theme was how to improve sales. With no single answer, the consensus was the key to successful prospecting is to have a consistent plan and discipline to stick to the plan, and make small tweaks as needed if the tracking data shows something is off. Measuring sales velocity is one of the metrics that was recommended. Sales velocity’s formula is:

(# of deals * deal value * % wins)/ length of sales cycle

It is said that only 30% of a sales person’s time is used to sell, so using the sales velocity formula as a tool, one can see which sales people are more effective than others. There was also much discussion about compensation, with house accounts getting lower commissions than net new business as (low-value offset) print volumes decline and print providers push to shift their business to higher-value add, lower-volume print jobs.

One lament is that the sales cycles are getting longer, as print buyers are having more decision makers involved in the buying process. With more people involved in the decision-making process, greater education is needed to educate the various levels of decision maker, especially for versioning or variable data print jobs.

Handling Complicated New State Taxation Issues

Another key topic was the on-going “Wayfair tax” implications on direct mailers. (Wayfair is a furniture e-commerce retailer which lost a court case noting it did not have to collect sales tax for products shipped to States it did not have “nexus” in).

Historically a business had to have “nexus” or a direct connection such as a sales office or factory to be taxed in that State. Today, a direct mailer sending a piece of direct mail can be categorized as a business that has delivered a product (not a service) into that State, and the State can charge a tax on the value of that product.

This has caused all kinds of chaos, as each of the 50 US States can have their own definition of what constitutes “nexus”, and what the value of a product might be. For example, postage cannot be taxed, but if the invoice has a single price for direct mail and postage, a State can insist that tax must be paid on the entire value of the direct mail piece that was delivered in its State since there is no way to prove it was excluded from the value on the invoice.

There are several issues that this has caused. One is that there are about 5-10 States now aggressively going after auditing direct mailers for collecting tax and penalties. Quad lost a case in North Carolina recently, and owed over $4M in tax. Triple AAA lost a case in Michigan and owed $3M. The question that arises is whether Quad pays for this tax, or does it go back to its customer to ask for additional money to pay for this tax? Once audited, if there is tax owed, it removes statues of limitations and a State can go back unlimited years to the time it implemented this tax to see if there are other direct mail jobs on which tax might have been owed. This potentially opens up a direct mailer to unfunded liabilities that could wipe or their profit or worse.

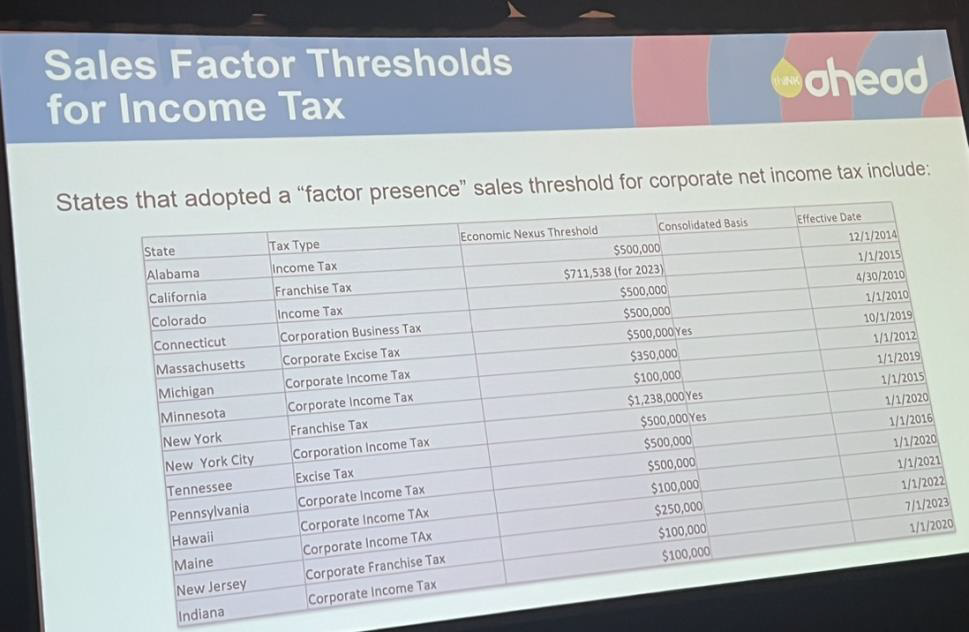

A second issue is that a direct mailer does not have the appropriate software (which is another minefield) to keep track of potential taxes, and takes a risk of hoping they will not be audited and does not accrue for a potential State tax, they could be pricing their jobs at a lower price than a direct mailer who does accrue for State tax. This creates uneven price competition, or what some would say is unfair price competition in the market place. Each State sets their own tax rate, and has their own threshold at which level of value the tax kicks in and must be paid (see figure 3).

A third issue that has arisen is that if a direct mail shop wants to sell its business, a potential buyer now wants to have an understanding of what potential future liabilities are at stake if the company they’ve acquired gets audited and is found to owe retroactive taxes and penalties. This means that any direct mailer, whether they decide to pay the tax or not upfront, will need to have software in place to track where they’ve mailed direct mail pieces, and what the value (broken out by paper, labor, postage, etc.) was of those jobs. Last, there is additional complexity when servicing non-profits, which might be State tax-exempt, but not sales tax exempt.

Figure 3 Various State Tax "Nexus" Thresholds that can affect Direct Mailers, and how far back those taxes can be collected

All of these tax issues are horrendously complicated, issues not easily handled by local accountants who are not familiar with out-of-state taxation matters. One thing is clear however, direct mailers have to start investing in software and other resources to track their out-of-state mailing jobs. It is a regulatory burden that comes on top of postage increases, one that will be very onerous to comply with, whose costs will have to be passed onto the brands who specify direct mail unless a direct mailer is willing to take a tax exposure risk.

New Opportunities

There were two sessions on Artificial Intelligence, and one on wide format print. The wide format print session highlighted the enormous profits (and risks if a job was not correctly printed - a yard sign whose corrugated holes lined up in the wrong direction so the signs could not be mounted onto the metal H brackets that hold up the sign) and new applications, ranging from using wide format printers to create sticker cut-outs in children’s books to creating wall-coverings for retailers, restaurants, and daycare centers. There is increasing price competition for simple jobs that can be produced by generalist (like commercial printers) and higher-value for jobs that entail multiple types of signage, at a sports/concert venue for example. Those who focus on understanding the complexities and needs behind each type of wide format print job appear to be thriving, even in what is now a 30+ year old application/market.

The Bottom Line

thINK Ahead 2024 attendees walked away with a much broader understanding of industry trends, opportunities, and challenges. They relished the networking sessions with friends, partners, and competitors, in the rarified environment of the Boca Raton Resort. The goodwill this event creates for Canon and its partners as the only consistent production inkjet user event is immeasurable, but one that is guaranteed to keep Canon and its partners sponsoring this event for many years to come.