RESOURCES

BLOG

Join in the community forum! The thINK blog is a place for community members to share their opinions, best practices, successes, and challenges. Add your comments to the blogs published here or write a blog and we’ll post it for you.

Tracking the Biggest Print-for-Pay Service Providers

Two important annual documents have recently been published: the Printing Impressions 300 and the In-Plant Impressions 2023 Largest In-Plants. The creators of both of these research projects have taken on the gargantuan task of extracting size and growth information from industry players that may not always wish to provide it. In different ways, these documents offer valuable insight into the state of the printing industry in both print-for-pay (i.e., commercial) and print-for-cost (i.e., in-plant) environments. This blog focuses on the Printing Impressions 300; the next in this series will highlight trends from the In-Plant Impressions report.

The Printing Impressions 300

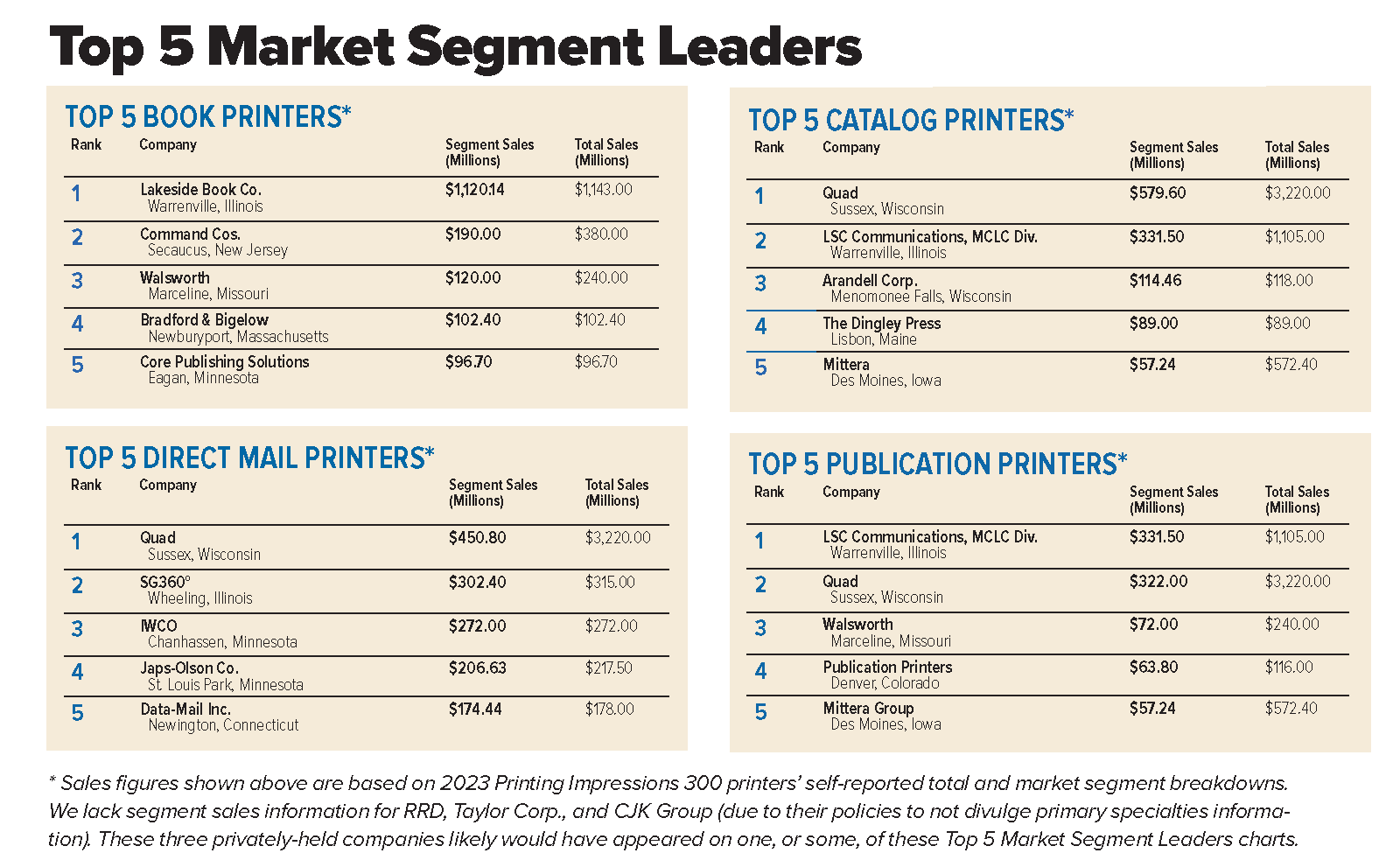

Since the 1980s, Printing Impressions magazine has been tracking the largest printers in United States and Canada, as ranked by their annual sales figures. This list initially included 500 companies, but the number has been dropping in recent years and went all the way down to 300 in 2021. Not surprisingly, the top company over those four decades has been R.R. Donnelley. This leadership has held true even after its breakup into three parts (R.R. Donnelley & Sons, LSC Communications, and Donnelley Financial Solutions).

The role of private equity in the printing market is highlighted by the fact that 6 of the top 25 companies on the Printing Impressions list are owned by private equity, including R.R. Donnelley & Sons. The authors of the list note that this “reflects an industry trend that continues to permeate throughout the graphic arts” and that the printing industry is an attractive target for private equity because it “has relatively consistent cash flows in comparison to many other industries, despite the tight margin pressures printers face.”

A newcomer cracked the top ten this time around: Eureka, Missouri-based Marketing.com. Marketing.com, another company owned by private equity, reached number 10 due to its $640 million in sales. The company has 32 locations and offers commercial printing, garment printing, mailing & fulfillment services, marketing support, and sign printing.

Small and medium-sized printers are another key segment of the 2023 Printing Impressions list. These are generally privately held and often family-owned and operated. Some of these print service providers (PSPs) are finding that as ownership ages and the next generation of the family becomes unable or unwilling to continue operating the company, they are increasingly looking to private equity to sell an entire or partial share, or to seek funding for capital equipment investments so they can automate.

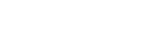

A revealing graphic from the report highlights the top five US and Canadian market leaders in the book, direct mail, publication, and catalog market segments. At the same time, however, strict segmentation has become more difficult due to application expansion as PSPs expand beyond typical commercial print areas like promotional documents in favor of apparel printing, creative services, packaging, and wide format digital printing. You will see this reflected in the full listing as companies break out their application areas by percentage across categories like book manufacturing, catalogs, direct mail, financial printing, garment printing, general commercial printing, industrial printing, inserts/preprints, newspapers, packaging, publications/periodicals, specialty printing, statements/transactional, and wide format printing.

It should be noted that the Printing Impressions 300 list will likely be of great value to those who work with the printing industry in one way or another. This includes:

- Businesses that provide equipment, software, and services relevant to PSPs

- Analysts, brand managers, marketers, media outlets, and market researchers

- Wall Street and private equity investment firms

The inclusion of factors like corporate headquarters location, C-level management, number of employees and manufacturing plants, and recent annual sales figures are particularly beneficial to these groups.

A few caveats are important to mention here. Not every company participates, and there are varying reasons for this. Some large companies may not be willing to share breakdowns withing various divisions. In addition, the timing of the request for information may not align with a company’s financial budget year. Businesses are told not to provide projected or estimated sales figures., which means that some companies may be reporting 2022 sales figures. In some cases, the report’s authors estimate sales figures for large public PSPs based on sources like Dun & Bradstreet. You may not see some of the more familiar PSPs listed because they are part of a larger graphic arts conglomerate.

The Bottom Line

You should take note of the Printing Impressions 300 and the In-Plant Impressions 2023 Largest In-Plants for the market insight they provide. Even more importantly, consider participating by providing as much information to the creators of these documents as you possibly can. Doing so will put you on the map, so to speak, and it helps to position the printing industry and its participants as a dynamic market that people sometimes overlook in a world that is hyper-focused on digital media.

Source: Jim Hamilton, Consultant Emeritus at Keypoint Intelligence

Author bio: Jim Hamilton of Green Harbor Publications is an industry analyst, market researcher, writer, and public speaker. For many years, he was Group Director in charge of Keypoint Intelligence’s (formerly InfoTrends’) Production Digital Printing & Publishing consulting services. He has a BA in German from Amherst College and a Master’s in Printing Technology from the Rochester Institute of Technology.