RESOURCES

BLOG

Join in the community forum! The thINK blog is a place for community members to share their opinions, best practices, successes, and challenges. Add your comments to the blogs published here or write a blog and we’ll post it for you.

Tracking the Biggest In-Plants

You have probably heard of the annual list of North American print-for-pay companies called the Printing Impressions 300.[1] The companion piece to this on the print-for-cost side is the In-Plant Impressions 2023 Largest In-Plants research study. Research like this is hard enough to conduct with commercial print service providers (PSPs) who may not always be willing to share financial and other relevant information publicly. Extracting comparable information from in-plants has its own special challenges. For US and Canadian in-plants though, there is much to be learned from the In-Plant Impressions study.

In-Plant Impressions 2023 Largest In-Plants

One of the biggest challenges to gathering the data for this research is that many organizations are unwilling to provide information on internal departments. The result is that some very large US and Canadian in-plants do not appear on the 2023 list. The researchers also report that some in-plants that provided information in the past have opted not to participate in the most recent research. Still others provide only employee counts, but nothing further. This is unfortunate because the list in this research covers only 60 in-plants. That being said, the resulting study—which includes answers to questions on topics of vital importance to in-plants—provides remarkable insight on the state of the in-plant market.

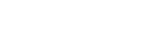

The list is sorted in two ways. The first is by the number of full-time-equivalent employees. In cases where the number of part-time or temporary employee employees were provided, the researchers added half of these to the full-time figure. The second way is by the dollar value in sales. In cases where no sales figure was provided, the researchers used the in-plant’s annual budget. Keep in mind that because of variations in fiscal years, these numbers may not align exactly one to another.

Of note are the following conclusions:

- Some in-plants are seeing growth in staff. By comparing 2023 reported figures to the previous year, the researchers concluded that 35% of the in-plants (21 of the 60 cited) have increased their staff in the past year.

- Government in-plants dominate the Top 10 (by budget/sales). 8 of the Top 10 in-plants (by budget/sales) are government printers, including many state-run in-plants.

- Higher education in-plants dominate the Top 10 (by employees). Higher ed in-plants account for 43% of the list. While there are certainly a lot of higher education in-plants, it also seems likely that this sector is highly represented because the management is more forthcoming about providing data than companies in other sectors such as finance.

- In-plants can be massive. This should come as no surprise, but the in-plants included in the Top 10 list have lots of employees. Nearly all of the Top 10 have at least 80 employees and the largest, the U.S. Government Publishing Office (GPO), has over 400.

The report highlights trends including data on revenue growth, services provided, major challenges, the growth of wide-format volumes, and equipment upgrade plans.

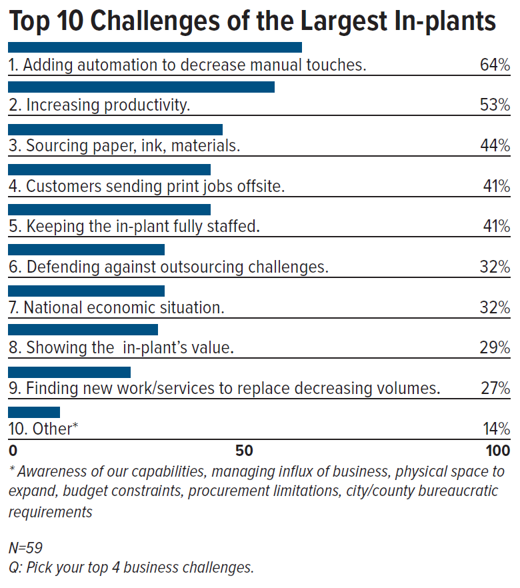

In reporting on perceived challenges, in-plant managers cited the following:

- Automation tops the list of perceived challenges. Large in-plants identified automation and reducing staff touches as the top challenge followed by a related factor: productivity increases. Sourcing, competition with outside printers, and staffing rounded out the top five challenges.

- In-plants have shifted away from offset. 54% of respondents said that they do all of their printing digitally. Across all respondents, the number of in-house impressions printed digitally was 84% (the median response was 100%).

- Respondents are reporting revenue increases. 73% of respondents reported some level of revenue increase. This is obviously very positive, but it should be tempered by the fact that struggling in-plants are less likely to have the time or inclination to participate in this survey.

Wide format volumes are expanding. Wide format work accounts for 16% of print volume. In addition, 73% of respondents say that their wide format volumes have increased over the previous year.

The Bottom Line

The In-Plant Impressions 2023 Largest In-Plants provides important insight on market size and trends. In-plant managers should definitely participate in this research and strive to provide as much information to the creators of these documents as possible. In-plants can sometimes be overlooked in discussions of the overall printing market. This study helps solidify the importance of in-plants, even as the printing industry sees continued competition from digital media.

Source: Jim Hamilton, Consultant Emeritus at Keypoint Intelligence

Author bio: Jim Hamilton of Green Harbor Publications is an industry analyst, market researcher, writer, and public speaker. For many years, he was Group Director in charge of Keypoint Intelligence’s (formerly InfoTrends’) Production Digital Printing & Publishing consulting services. He has a BA in German from Amherst College and a Master’s in Printing Technology from the Rochester Institute of Technology.